Beginning a new business can be challenging, but having one of the best business credit cards for startups can make many aspects easier and streamlined.

You’re probably using FreshBooks or QuickBooks to track expenses and income, but what about funding your business when you need cash?

Learn about the cards, what they offer, benefits to cardholders, and how you can apply for your own today.

Contents

Can You Get a Business Credit Card at Startup?

You can get a business credit card if the startup owner approves the business credit card.

Can You Apply for a Credit Card With Your EIN Number?

You can use your EIN to apply for a business credit card.

Your EIN is your employer identification number assigned by the Internal Revenue Service (IRS).

However, to do this, you must also supply the credit proprietor with your social security number.

Once you establish your business with the IRS and receive your EIN, you will be able to apply for a small business credit card using this number.

How Much Business Credit Can I Get?

The amount of credit you get on your business card will depend on many factors.

You can get as little as $5,000 if you have few business expenses, employees, and property.

But you can also receive as much as $250,000 if you need expensive equipment, a team of employees, or space to rent.

There are more factors to consider, such as your personal credit score, assets, or proven profits, but you won’t know how much you can get until you reach out t credit proprietors and apply.

Do You Need a Business Credit Card?

You don’t have to have a small business credit card.

However, many perks come along with a designated business card, and it can also protect your personal finances from becoming muddled with your business finances.

Benefits of a Business Credit Card for Startups

When starting a new business, you must determine what you need and what you don’t.

A small business credit card isn’t technically a necessity, but there are many benefits it can offer startups.

Track Expenses Easily

Tracking your business expenses is a crucial part of running a business.

If you don’t keep track of business costs, it can easily become a massive problem when tax season rolls around or your next budget meeting.

Putting all or most expenses on a designated business credit card

It Doesn’t Affect Your Personal Credit Score

It’s useful to keep your personal credit score and your business’s credit score separate.

If your company goes under or struggles, it won’t directly or immediately affect your ability to apply for personal credit cards, personal loans, finance a car, or rent a home.

Lowering your credit score is easy, but getting it back up to a decent number can take years or never happen.

It’s best you avoid this disaster, even if your business is likely to succeed.

Welcome Offers

Credit card companies and banks love to offer you enticing offers to welcome you as one of their customers.

There can be cash bonuses, airline miles rewards, reduced or eliminated fees on charges abroad, and more.

These offers can be beneficial when running a startup because these little rewards can make business operations easier and more lucrative.

Business Perks

Many welcome offers are also on personal credit cards, but business perks are different.

Business perks are offers and rewards specifically designed for small businesses to be successful while using their credit.

Overall, using a business credit card can improve your business credit, helping to establish a reputation in the financial world.

But there are also some perks designed to help with payroll or equipment costs.

High Credit Line

Business credit cards are for entities expected to be profitable.

Because of this, many credit proprietors offer much higher lines of credit, as they expect a large amount of credit will yield higher profits from the business.

If you only get a few thousand dollars of credit for an entire business it likely won’t be enough to help you succeed.

Best Business Credit Cards for Startups

To ensure you choose the best business credit card for your startup, this is a roundup and review of the best business credit cards.

These cards are excellent for businesses just getting started that will benefit the most from perks, rewards, and flexible fees.

To reap the rewards that business credit cards have to offer your company while in its infancy, check out these six exceptional business credit cards.

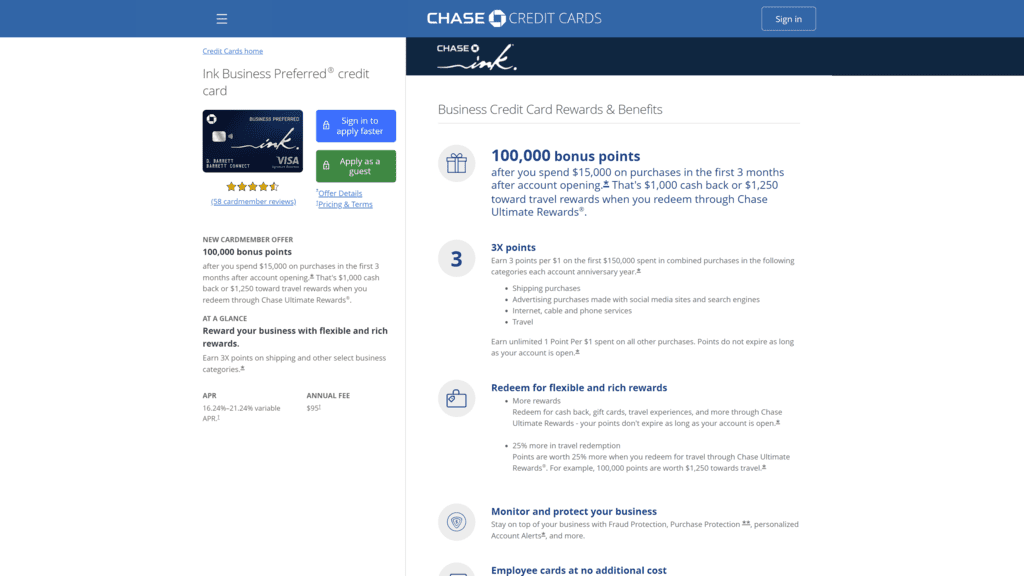

1. Ink Business Preferred

The Ink Business Preferred credit card has major benefits for small or large startups.

Credit Score Requirement

When applying for this business credit card, it’s best to have a FICO score of at least 700.

Some business owners can qualify for this card with a score as low as 640, but those people typically have other assets or evidence of financial reliability.

Welcome Offer

Chase Ink Business has a welcome offer that states if you spend $15,000 or more on purchases within the first three months of the account opening, you can receive $1,000 cashback or $1,250 worth of travel credit.

APR

The APR will be between 16.24% and 21.24%.

The APR will be decided based on your creditworthiness.

Annual Fee

The annual fee for the Chase Ink Business Preferred card is $95.

As far as credit card annual fees go, this amount is reasonable and fairly average.

Benefits

For every dollar you spend, you receive one point toward rewards and cashback.

For every dollar you spend with the Chase Ink Business card on shipping, advertising, internet, cable, phone services, and travel, you earn three points!

You can also add employee cards to the account for no additional fees.

When redeeming points with Chase Ultimate Rewards, you will earn 25% more.

So this card is an excellent choice for someone that must travel or send employees on trips a lot for business reasons.

2. American Express Blue Business

For the AMEX Blue Business card, you have two options: points or cash.

There is the Blue Business Plus card and the Blue Business cash card.

The Plus card focuses on giving you points back on travel and other expenses, while the Cash card gives cashback on any purchase.

Credit Score Requirement

The lowest credit score you can have and still qualify for the AMEX Blue card is typically around 670.

However, they prefer applicants to have a FICO score over 700 and closer to 730.

In general, AMEX is known for having steep requirements for credit qualifications.

Welcome Offer

The welcome offer for the Plus card is 15,000 card membership rewards points after you spend $3,000 on an eligible purchase within your first three months of opening the credit account.

On the cash card, the welcome offer is a cash bonus of up to $500 if you spend $5,000 on the card within the first six months and then $10,000 on an eligible purchase within the first year of having the account.

APR

The first year has zero APR, and after that, it can be between 13.49% to 21.49%.

The APR depends on your credibility and current use of the card.

You will likely receive a lower APR if you use and pay off the card within the first year.

Annual Fee

There is no annual fee on this business credit card.

The lack of annual fees is excellent for those that only want to use the card as needed after the first year.

Benefits

The lack of an annual fee is one major benefit of using the AMEX Plus or Cash business card.

But you can also get reward points, travel credit, shopping benefits, and more.

When traveling, you automatically get theft and purchase protection insurance on rental cars.

You can also access their global assist hotline, a 24/7 assistance line for cardholders traveling.

You get 2% back on the first $50,000 you spend, and 1% after that.

When shopping, you receive additional warranties and purchase protection plans via AMEX.

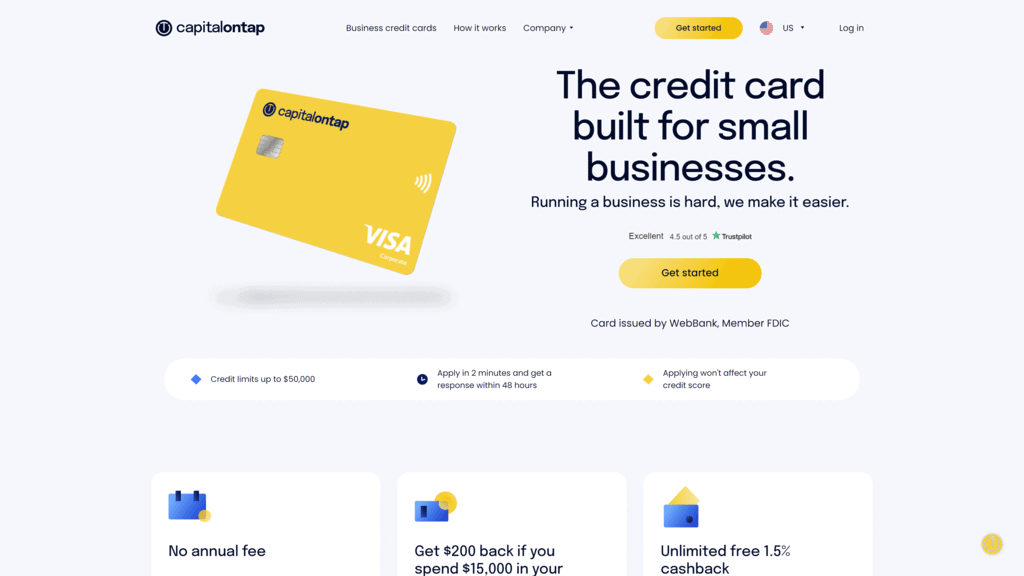

3. Capital on Tap Business Card

The bright yellow Capital on Tap business card is for small businesses that need lines of credit to be successful.

For this card, you can only get a line of credit of up to $50,000, which is why only smaller businesses consider this the best credit card.

Credit Score Requirement

They want you to have a credit score of 670 or higher, making them one of the lower requirements on this list.

Unlike other cards that give a wide range and consider other factors, Capital on Tap is simpler to qualify for with a moderate or fair FICO score.

Welcome Offer

The welcome offer on this card is also pretty straightforward.

They offer $200 back if you spend $15,000 on a purchase in your first three months.

Not the best welcome offer on this list, but their other benefits and focus on small businesses still make them great options for startups that need a line of credit.

APR

The Capital on Tap card has a wide range of APRs you can get.

They span from 9.99% to 34.99%.

However, 9.99% is among the lowest APRs you can get on a business credit card.

So if you have good credit, you can save money on interest fees with this card.

Annual Fee

This is another card with no annual fees! It’s as simple as that.

Benefits

The lack of annual fees and the possibility of such a low APR are two of the main benefits that small business owners appreciate.

In addition, you can also get unlimited free 1.5% cashback on any purchase made with the charge card, making business expenses an asset to your credit.

Capital on Tap can also give you unlimited employee cards to give your team free of charge, so they can handle some of the combined purchases and expenses while you can still monitor the account.

And lastly, there are no foreign exchange fees, making it easier to do business abroad and travel for your company.

4. Brex 30 Card

For small businesses, the Brex card is hands down one of the best options.

It has incredible benefits with few fees and makes it easier to manage your small business expense and be successful.

Credit Score Requirement

The Brex card works differently in that they don’t base your eligibility on your personal credit score or personal guarantee.

Instead, they base eligibility on cash flow, spending patterns on a purchase, and investors.

Essentially, the Brex corporate card agrees to issue a credit to a business heading toward success rather than a financially stable individual that owns a startup.

Welcome Offer

Their welcome offer is 50,000 signup bonus points after spending more than $9,000 in the first 30 days of the account opening for the credit card.

This welcome offer works for businesses actively growing and likely to spend around $10k within the first month.

APR

There is no interest within the first year of the account opening the credit card.

After that, it is a variable APR between 13.49% and 21.49%.

These rates are variable, meaning they can change over time depending on your spending and paying habits.

Annual Fee

No annual fees here!

Because this corporate card is to help you grow and be more profitable, they don’t want to weigh you down with unnecessary fees, so they don’t.

Benefits

The benefits of this corporate card focus on earning points on specific combined purchases.

The reward system works by offering:

- 7x the points on rideshare

- 4x the points on Brex travel

- 3x the points on restaurants

- 2x the points on recurring software (Photoshop, Excel, etc.)

- 1x on everything else

They also perform receipt matching on expenses to prevent or catch fraud, and you can give your team an unlimited number of employee cards and set a specific credit limit on each one.

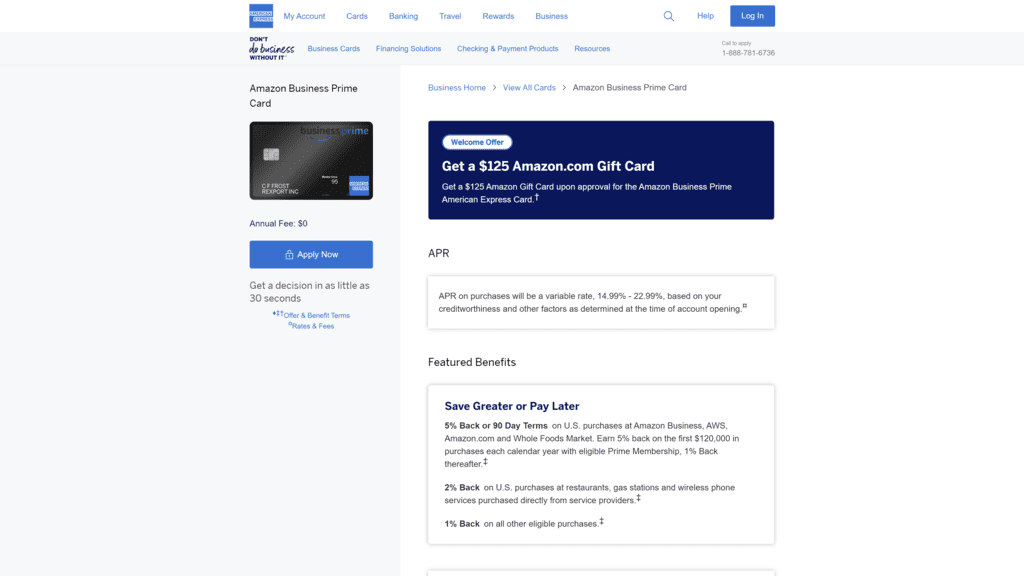

5. Amazon Business Prime

If you use Amazon a lot for your business, this card can do wonders to boost your cashback and save you money on company expenses.

The corporate card is technically an AMEX card but offers more flexibility for those looking to qualify with a lower FICO score.

Credit Score Requirement

Their credit score requirement is pretty relaxed, but they want applicants with a FICO score of 690 or higher.

However, this isn’t a difficult card to qualify for compared with other options on this list.

Welcome Offer

Their welcome offer is a $125 Amazon gift card for an Amazon purchase upon approval for the Amazon Business Prime American Express Card.

So all you need to do is qualify and signup for the card, and you receive this gift card.

There is no spending requirement.

But this is a low offer compared to other cards.

APR

The APR on this card will be between 14.49% and 22.49%.

This rate is considered fair but not excellent.

So make sure you pay this card on time and in full to avoid such fees and save your business money.

Annual Fee

Here is another card with no annual fees.

In general, newer credit cards and banks have been moving away from annual fees because they are an unnecessary money grab, considering the proprietors usually make plenty of interest profit.

Benefits

No surprise, you get rewarded when you shop on Amazon or affiliated companies.

So you get 5% back on U.S. combined purchases at Amazon Business, AWS, Amazon.com, and Whole Foods Market.

You earn 5% back on the first $120,000 spent each year with an Amazon Prime card membership.

You also get 2% back on purchases at restaurants, gas stations, and wireless phone services purchased directly from service providers, and 1% on everything else.

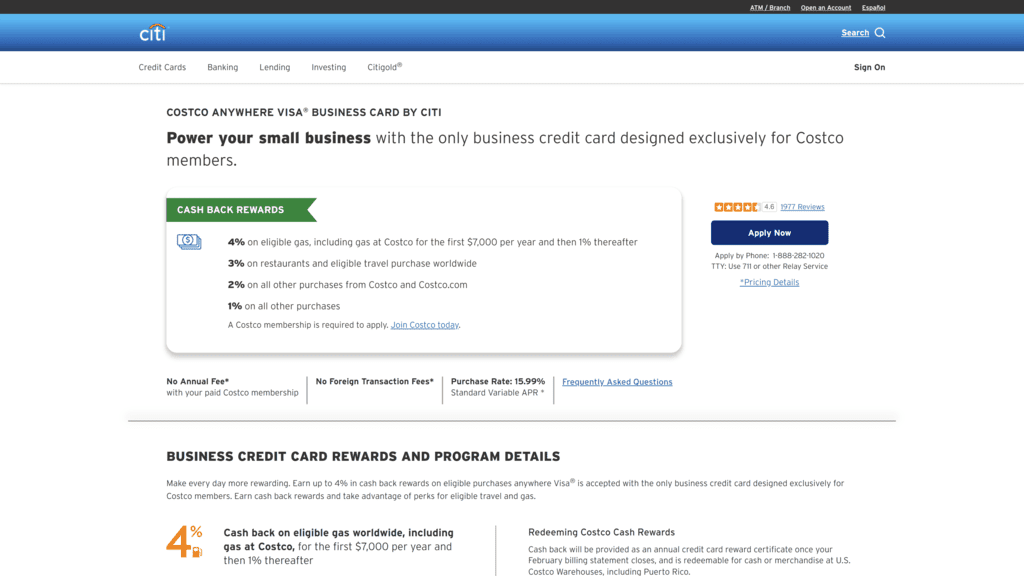

6. Costco Anywhere Business Card

If you shop at Costco already, you earn money back on those purchases.

However, they require good credit, and many may not like their benefits as much as other cards on this list.

Credit Score Requirement

For this card, you need an excellent credit score of at least 750.

Don’t bother applying if your FICO score is below this, as they refuse to assume much risk when issuing this line of a statement credit.

Welcome Offer

There is no welcome offer on this card.

There are no introductory APR or fee waivers, and no other signup bonuses or rewards.

APR

They have a variable APR, with the average rate being 15.49%.

This rate is pretty low, and they tend to lower it when you stay on top of your payments while spending significantly.

Annual Fee

There are no annual fees on this card, exemplifying,

again, how statement credit proprietors are trying to move away from these unnecessary charges.

Benefits

There are no annual fees or foreign purchase fees.

You also get 4% on gas, including gas at Costco in the first $7,000 per year and then 1% after that.

Plus, 3% on restaurants and qualifying purchases while traveling worldwide, 2% on all other purchases from Costco and their online store, and 1% on all other qualifying purchases.

Wrapping Up

If you’re beginning a new company, it is valuable to have a line of statement credit designated for your business.

Startups often need money to make money, and the business cards on this list all have unique benefits and rates that can work for different businesses.

You shouldn’t risk your personal credit card when you can establish the finances of your company separately with one of these supreme business credit cards.