With more business owners, bloggers, and entrepreneurs either launching new businesses or startup of their own, or focusing on branding, it’s important to ask yourself if you are taking advantage of the financial upswing?

The majority of site owners and bloggers start out with nothing, however, initial startup costs and financial investments are always going to be something to consider.

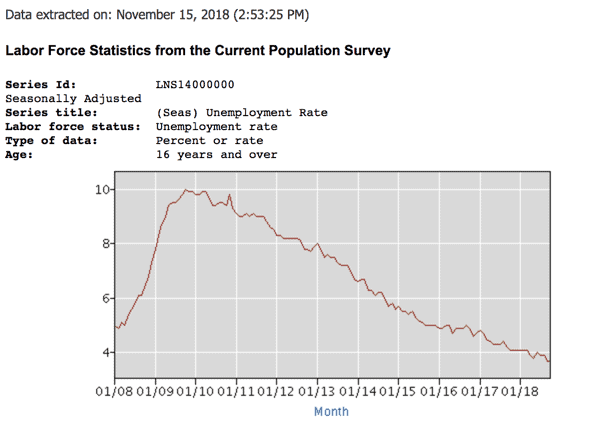

As unemployment rates flirt with record lows, consumer confidence continues to skyrocket. That has boosted the average annual expenditure consumers put towards goods and services.

The important question here is… What does that mean for you?

It means that if you can launch your business in today’s marketplace, your opportunity to recoup your investments and turn staggering profits are astronomical.

The only issue is that finding funding to launch your business can be a challenge.

With new businesses comes the need to fund office spaces, equipment, employee salaries, and more while you work to get a foothold in consumer’s consciousness.

The good news is that there are lots of ways you can secure business financing and in today’s digital age, it’s easier than ever.

Below you will find a list of nine solutions that can get your website, blog, startup or local business funded today.

9 Different Ways to Get Business Financing for Your Blog or Business

1. Bank Loans

We’ll open up our list of funding solutions with what is perhaps the most conventional business financing option available to you: bank loans. Bank loans get acquired by setting an appointment with a loan officer at any major financial institution.

During that appointment, you’ll likely get asked to provide information regarding the business you’re looking to open up. You will also share what your plan is to turn a profit.

In the latest edition of the State of Online Banking, it was also highlighted that other factors like your current finances and credit will enter into the consideration of your prospective lender.

If your lender feels that your plan is sound and trusts that you’ll be able to pay back your loan, you will receive your funding at an interest rate agreed on by you and your lender.

Getting bank loans can be difficult given stringent criteria often set by lenders to mitigate their risk.

2. Online Loans

Online loans are similar in some aspects to getting a traditional bank loan.

When we say “online loans”, we’re referencing solely internet-based lenders. Typically, these loans come in at higher interest rates than what traditional lenders would offer.

The plus side to taking out this type of loan is:

- A) You can secure them quickly.

- B) You won’t have to answer many questions.

To secure an online loan for your business, you may need to do as little as just show you have income and a checking account. More thorough online lenders will also make it a point to run your credit.

If you go down the online loan path to secure your business’ funding, you’ll want to pay very close attention to interest rates and fees. Many online lenders border on predatory and falling into debt with one of them could spell ruin for your company.

3. Borrow Against Your Stock Portfolio

If you have extensive investments in the stock market but little in the way of cash to fund your business, there are companies out there that will allow you to use your stocks as collateral and borrow business financing against their value.

These types of loans solutions are excellent. This is because they provide another lever prospective business owners can pull to get their products to market.

There are regulations and details you’ll want to brief yourself on prior to exercising this option. Not all market investments will be eligible to borrow against. Which ones are eligible will be determined, in part, by each individual lender.

Be sure to do your research before transferring your portfolio to an online lender. Ensure that you’re not entering into a predatory arrangement that could result in the loss of your investments.

4. Credit Cards

Another go-to means of securing business financing are credit cards.

Many people have experience using traditional consumer credit cards. Business credit cards can be different in what they look for in applicants and what they offer to users.

For starters, in order to secure a business credit card, you may be required to provide an EIN number on your application. This number can get acquired for free by registering for one through the IRS.

For sole-proprietor businesses, some card applications will accept your social security number in lieu of an EIN.

If your application gets approved, your business credit cards will typically come with a much higher limit than you’d get through a standard card. It may also offer you perks that award cash back on things like internet service, transportation, and more.

As with all credit products, stay mindful of your card’s interest rate. Be sure that you’re managing your payments in a way that will keep your company from falling into insurmountable debt.

Related: The best business credit cards for small businesses

5. Consider Leveraging Your 401K

If you’ve worked as an employee for another company, you probably have a nest egg built up for your retirement. In most instances, borrowing against that nest egg would result in steep penalties.

However, investing your 401K in business financing, if managed by a tax professional who is experienced in setting up C corporations, can be accomplished without incurring fees.

The same is true if you to borrow against your IRA or ROTH IRA.

Remember, there are risks involved when funding your business with your retirement accounts. If your business fails, not only will you lose your job but your retirement gets lost too.

6. Crowdfunding

While not for everyone, crowdfunding is a low-risk means of getting a business idea off the ground.

Crowdfunding is the process of pitching average people on your business idea. This is typically done by showcasing a “media kit” online which gets made up of videos that describe your idea, information on how your idea can revolutionize a market, and more.

If enough people get compelled by your vision, they can pledge micro investments ($5.00 and up) to help you meet your funding goal.

In exchange for their investments, pledges get prizes depending on how much they invest. Prizes get described in an incentives document your organization will create.

The difficult aspect of crowdsourcing is that very few ideas get funded successfully. You’ll need to invest in a showy pitch/media kit to come anywhere close to your funding goal.

The good news is that if your idea does get funded, beyond giving investors their prizes as promised, you are not beholden to your investors. They are not entitled to royalties on your business’ future success.

Oculus is a notable project made possible through crowdfunding which was later sold to Facebook for 2 billion dollars.

7. Kiva

Kiva is a business financing provider that gives free funding to businesses that are usually based in 3rd world countries. Still, many businesses that are US-based can also get funded through the platform.

In order to get funded through Kiva, you’ll likely need to be part of a disadvantaged community as investors on the platform are interested in helping reshape economies by assisting underserviced populations open businesses.

Still, no matter what your background is, given that Kiva is 100% free, there’s no downside to putting your ask out on the platform.

Kiva offers a flexible payback structure on all business financing serviced through its platform and repercussions for not paying back loans are nominal. Despite that, given the incredible value Kiva provides to underserved entrepreneurs, the graciousness of borrowers has fueled a loan payback rate of 96.8%.

8. Family and Friends

If you’re lucky enough to have a great support network of family and friends, you may be able to secure business financing by pitching them on your idea.

For some, going into business with family members is a rewarding experience that can bring them closer together. For others, being in business with family and owing them money can lead to friction which can decimate relationships.

For that reason, we recommend you tread lightly when looking to engage family and friends for loans. Be sure that nobody is staking their livelihood on your success, and be honest in your intentions to pay people back.

9. Paypal, Kabbage and Online Lending Programs

As you can imagine, the internet has drastically changed the way financing and banking works in the world today.

To bring our nine point list of financial solutions to a close, we simply have to add some amazing opportunities that can be found through providers like Paypal and Kabbage. Both of these platforms allow for businesses to borrow money, almost instantly.

In both cases, all it takes is creating an account and filling in some company details.

For anyone using Paypal to collect and pay for business services online, Paypal Working Capital is perfect.

Kabbage is also great for Paypal users as well, as you can connect accounts and increase the credit line based off your income/revenue history.

Wrapping Up

You have a killer business idea, and all that stands between you and your success is getting the funding you need to get it off the ground. To that end, we recommend leveraging any one of the business financing tips we’ve listed above.

Given their diversity of approaches, you’ll find the success you’re looking for leveraging at least one of them!

Want more of the most thought-provoking advice your business can leverage to find success? Do you want that information online right now?

If so, get the big picture when it comes to local and global economic questions. Start diving deeper the our content pool at Blogging Tips!