Registering your business as an LLC is an essential step in someone’s journey as an entrepreneur.

There are numerous factors to consider, and trying to keep track of everything can feel overwhelming.

Organizing your finances, however, is a priority.

We’re going to say BlueVine is the best option on the list, as they give you little to no fees for opening an account with them, they don’t require a minimum balance, and they offer excellent customer support, business lending options, and software integration.

When you decide to acknowledge your business as a separate and legal entity, it’s critical to select the best business checking account for LLC that suits your needs.

With so many options, it’s hard to narrow it down to just one. We’ve done the research and have some great suggestions.

Contents

An Overview of a Business Checking Account for LLC

In a nutshell, your business banking account will assist you with managing and tracking money from your business venture.

A bank can offer small to large business owners a specific type of checking account, regardless of their business type.

These accounts have multiple features and tools, which are valuable and pertinent to operating a business smoothly.

What Is a Business Checking Account?

Business checking accounts aren’t much different from personal checking accounts.

You can make payments, withdrawals, deposits, use a debit card, do transfers, and so on.

One of the key differences is that your personal checking account is for personal funds, while the business checking account holds money generated by your business.

More fees are generally associated with a business checking account over a personal account.

Additionally, the business checking account for LLC comes with many other benefits tailored to business owners.

For example, even your most basic account will offer invoicing services, lending options such as a business line of credit, and more.

The account may also include merchant services, which is the ideal option for those who are in e-commerce.

Here are the primary reasons you’ll want to make a sound decision regarding which establishment gets to handle your business funds.

Why Is a Business Checking Account Important?

The primary reason that a business checking account is vital is that it allows you to track your expenses more easily.

A business account makes you look more professional and lends credibility to your company.

When you work with vendors, they’ll receive checks that have your business name and not your name and personal account info.

Additionally, you can avoid legal liability and tax fraud issues for unpaid taxes, and it helps you to budget better when your finances are separate.

Depending on the institution, you’ll also have access to a business credit card, line of credit, or a business loan when you need it.

Best Business Checking Account for LLC

The best business checking accounts for LLCs come in many shapes and sizes.

There’s not necessarily a one-size-fits-all solution, which is why you want to survey the field and know your business goals regarding money.

The main deciding factors will be how much money you’re moving in and out of the account and the number of monthly deposits you’ll make.

Most of the basic services you’d need with your account are free, but others come with a small fee.

Take a look at these premium business checking account options for your LLC:

1. BlueVine

Overview

BlueVine is at the top of many people’s lists because it is a well-rounded and sophisticated business checking account provider.

For small businesses that are looking for a basic checking account with a few perks and don’t mind an online bank, BlueVine is the way to go.

Applying for a business loan takes a few minutes; you can pay your bills and accrue interest at a decent rate without incurring monthly fees.

You can get your BlueVine account up within ten minutes with a smooth and easy application process.

Our Rating: ⭐⭐⭐⭐⭐

Best For: Unlimited Transactions

Notable Features

- Free debit card: As soon as your application gets approved, BlueVine will mail your debit card within ten days.

You get to choose between a few designs and colors as well.

- Accounting software integrations: Accounting software is critical to make it more organized and accurate for those who have difficulty balancing their expenses.

You’ll be able to integrate Xero and QuickBooks seamlessly.

- Business payment integrations: Connect your business checking account to payment solutions such as Expensify, PayPal, and Stripe.

Pros:

- Unlimited transactions: You can make as many transactions as you want each month without fear of exorbitant fees.

This benefit is particularly valuable for business owners that consistently deposit, withdraw, or transfer money from their accounts.

- Access to cash deposits: Some business accounts only allow electronic deposits, whereas BlueVine allows checks and cash deposits into your checking account.

Mobile banking includes the possibility of depositing a check right from your couch by taking a picture through the app.

- No deposit: There’s no minimum amount that you have to deposit to open their business checking account.

- No fees: Generally, there are a few for not maintaining a specific balance in your account at the end of the month.

With BlueVine, they don’t charge you any monthly maintenance fees.

- Physical checks: For those who prefer paper checks, customers can get two free checkbook orders each year.

Cons:

- Limited customer support: It would be better if BlueVine offered some form of customer service around the clock.

However, you can only contact someone from the customer support team during the week.

- Fees: Though BlueVine accepts cash deposits, you have to pay a small fee for each one.

- No business savings accounts: Usually, customers that sign up for a business checking account may open a business savings account at the same branch.

This bank doesn’t offer a savings account to separate your working capital from the money you use for expenses.

Pricing & Plans

BlueVine doesn’t charge transaction or monthly fees to have a business checking account.

You don’t have to worry about balance requirements or a minimum deposit to open an account.

General fees:

- Unfortunately, there is a fee of $4.95 for every cash deposit, and you can only deposit at a Green Dot location.

- ATM Fees: There are no ATM fees if you use one of the MoneyPass locations.

You pay $2.50 in addition to the operator fees when using an ATM outside the network.

Interest Rates

BlueVine offers an excellent APY on the business checking account, featuring a return of 1.5 percent on any balance up to $100,000.

You’re only eligible for this APY rate if you spend at least $500/month with your debit card or receive $2,500/month from customer payments directly deposited into your account.

Our Take

We think BlueVine is a top-tier business checking account without fees and one of the best APYs in the industry.

It doesn’t take long to open an account, customer service is reliable, and any business owner who needs an account allowing unlimited transactions should try BlueVine.

2. Capital One

Overview

Capital One is a traditional bank that offers two choices for a business checking account.

There’s the Basic checking account—with mobile and online banking, unlimited fees (electronically), low balance requirements, and then the Unlimited business account.

This type of business account comes with two Basic checking accounts.

Have you got complicated finances? Capital One can help you sort things out.

Remember that you must enter a physical branch to open the account at Capital One in New Jersey, New York, Texas, Virginia, Maryland, Louisiana, and Washington D.C.

Our Rating: ⭐⭐⭐⭐

Best For: Mobile Banking

Notable Features

- Reliable customer service: Capital One ensures that customer service is accessible 24/7 to offer support by email, phone, or in-person at one of their many branch locations (during business hours).

- Free cash deposits: If you don’t move a lot of money in and out of the account, you should avoid fees as you get up to $5,000 in cash deposits every month at no cost.

- Business solutions: Capital One has a solid array of business credit cards at your disposal.

Some come with travel and cashback rewards, plus there aren’t any fees for foreign transactions.

It’s an excellent option for those who travel abroad to conduct business.

Pros:

- No maintenance fees: Keep the money you deposit by avoiding monthly minimum balance fees.

This setup is ideal for new or small businesses starting to generate substantial income.

- Competitive interest rates: Capital One’s interest rates are comparable with the best interest rates in the industry.

- Digital transactions: You can carry out as many digital transactions as you want each month without penalty.

- Mobile banking available: The mobile app is easy to use and allows customers to manage their funds and make decisions on the go with the Capital One app available 24/7.

- No overdraft fees: You’ll never have to worry about paying ongoing fees because of an overdraft.

They still provide overdraft protections, however.

- Self-service escrow services: You can organize and manage your escrow funds anytime using the online banking program.

Cons:

- Low savings rates: There’s no APY earned on your checking account, and the savings rate is low.

- Can’t apply online: At the moment, you have to visit a branch to apply for an account; this is inconvenient for people who don’t live nearby.

- Limited availability: Capital One only has physical branches in seven states throughout the United States.

Pricing & Plans

Capital One has two business checking accounts. Here are the fees for a Basic checking account:

- Monthly fee: $15 (steep compared to competitors)

- The bank will waive this fee if your balance is over $2,000.

- Customers get free cash deposits up to $5,000/month.

Here are the fees for an Unlimited checking account:

- Monthly fee: $35

- The bank will waive this fee if your balance is over $25,000.

- You get free cash deposits with no limits for this account.

- You receive five outgoing wires for free with this account.

General fees:

- ATM fees: ATM transactions are free at over 70,000 MoneyPass, Capital One, and Allpoint locations across the country.

Interest rates

Capital One doesn’t offer an APY rate for their business checking account options.

Our Take

Though Capital One isn’t available everywhere, it’s still a solid banking option with mobile capabilities.

The app is clean and easy to navigate; you can do everything through the app that you could do in person, including initiating withdrawals in advance.

Capital One also offers many other products, such as credit cards, that you might qualify for if you can get approved for their business checking account.

3. CIT Bank

Overview

CIT Bank is one of the names on the list that isn’t as popular as the others, but it should be.

As a First-Citizens Bank & Trust Company division, CIT Bank offers online banking and innovative business checking account solutions.

They’re one of the only banks that allow you to have separate accounts for your LLC under the same name.

This option would be perfect for young business owners who are just starting on the road to success and want a flexible account that won’t charge fees.

Our Rating: ⭐⭐⭐

Best For: Ease of Use

Notable Features

- ATM reimbursement: One of the best features of CIT Bank is that they don’t charge any ATM fees.

All domestic transactions at an ATM are free, and they’ll reimburse you up to $30/month when using another bank’s ATM.

- Mobile deposits: You can make mobile check deposits through their simple and effective mobile app. You’re also allowed to do unlimited disbursements and withdrawals through the app.

- Contactless payments: CIT Bank sends you a free debit card with EMV chip technology, allowing for contactless payment; it’s quicker and easier.

Pros:

- No balance requirements: After you open an account, you don’t have to worry about fees for not keeping a certain amount of money in your account at all times.

- FDIC insured: The financial institution complies with FDIC requirements and regulations.

- Competitive interest rates: CIT Bank’s checking account pays 0.10 percent to 0.25 percent APY, which is much higher than the nation’s average of 0.03 percent.

- Mobile-friendly: You can download the CIT Bank mobile app on your Apple or Android devices.

- Versatility: CIT Bank offers multiple business checking account options for all types of companies, from small to large.

- No monthly fees: Manage your business with confidence when you open an account with CIT Bank, as they don’t charge any fees for a business account.

Cons:

- No physical branches: Though online banking is convenient; sometimes there are issues you would instead resolve in person.

You’ll have to do your banking through the app and online only.

- No ATM cards: You don’t get an ATM card, which is somewhat unusual with a personal or business account.

- No signup bonus: Many banks offer an incentive for choosing to do business with them, commonly in the form of a signup bonus.

CIT Bank doesn’t give any rewards for opening a business account.

Pricing & Plans

You must deposit at least $100 to open a business checking account with CIT Bank.

However, the account has no additional fees (balance requirements, cash deposit, overdraft, monthly fees, etc.).

General fees:

- ATM fees: CIT doesn’t charge ATM fees, and they’ll reimburse you up to $30/month for fees incurred when using an ATM that’s not in the network.

Interest Rates

If you have a business checking account with a balance of at least $25,000, you’ll earn 0.25 percent APY.

If your balance is less than $25,000, you’ll earn 0.10 percent APY.

Our Take

CIT Bank is an excellent choice for small to large business owners that enjoy high-interest rates, low to no fees, and you don’t mind being able to visit a physical branch.

You can open your account online without the hassle, making it a quick solution for someone needing a business account for their LLC.

4. Kabbage

Overview

Kabbage business bank is a suitable selection for a small business owner who wants a line of credit along with a business checking account.

This institution has high approval rates for small business loans to get a line of credit up to $250,000.

Kabbage also has other programs that benefit businesses, such as Kabbage Payments, Kabbage Insights, and Kabbage Funding.

A business checking account is a perfect accompaniment if you’re already familiar with these services.

Note: Kabbage is not a bank; they are a subsidiary of Green Dot Bank.

You must currently be a Kabbage customer before you can open a Kabbage business account.

Our Rating: ⭐⭐⭐⭐

Best For: Small Business Owners

Notable Features

- Business Resources: Kabbage easily integrates with business resources they already offer, which can assist a business owner.

They provide software and services for funding, payments, and performance insights.

- High APY rates: The Kabbage business checking account earns 1.10 percent APY if your balance is $100,000 or less.

You don’t get any interest for aggregate balances that total more than $100,000.

- Unlimited transactions: You can conduct as many electronic transactions as you want without paying fees; this is a massive bonus if you constantly transfer funds in and out of the account.

Pros:

- Savings program: One unique feature of the Kabbage business checking account is that you can create up to five “Reserves.”

These separate savings nests help you better organize your business finances and budget how much you’re spending.

You can utilize these reserves for individual projects, emergencies, or savings in general.

- Free mobile check deposit: There’s no charge or limit on how many checks business owners can deposit through their mobile app.

- Free and vast ATM network: Business owners will not incur any fees for using one of the 19,000 All point ATMs.

You may also make cash deposits at any of the participating Green Dot retailers in the network.

- Low to no fees: With Kabbage, there are no monthly fees for their standard services, nor do you have to maintain monthly or daily balance minimums.

- Easy setup: The application process is easy and requires less than ten minutes.

Cons:

- Daily limits: Kabbage limits how much cash you can withdraw daily to $2,000.

Depending on your size and type of business, this may become problematic if you need to get more.

- Online-only: The absence of a brick-and-mortar may not be an ideal option for someone who prefers to visit a physical branch from time to time.

- No business integration options: Outside of the programs they offer as a bank, you can integrate your business checking account with other third-party applications for invoicing, accounting, and so on.

Pricing & Plans

You’ll see no monthly fees if you sign up for a Kabbage business checking.

You don’t have to deposit a certain amount to open an account, and you won’t face any penalties or charges for doing transactions online.

Here are some of the other fees that you can expect.

General fees:

- Making a cash deposit isn’t free; you’ll have to pay as much as $4.95 per deposit.

- Though you can use their Allpoint ATMs for free, you’ll pay up to $3 for each transaction with an ATM that’s out of the network due to that ATM network charging you.

- If you travel abroad for business and use your debit card, there’s a three percent foreign transaction fee.

Interest Rates

Kabbage’s APY of 1.10 percent is higher than what most banks offer as interest on a checking account.

Remember that you can have a balance of up to $100,000 to qualify.

Our Take

Kabbage provides customers access and services as though it were a typical bank while remaining convenient with online banking features and services.

Remember that you have a better chance of qualifying for a business line of credit at Kabbage, which also offers an attractive APY rate.

5. Bank of America

Overview

Bank of America is another quality bank on the list that you can use to support your LLC as it develops and grows.

There are two different checking accounts that you can choose from; monthly fees accompany them, but you can waive the fees easily.

You can go back and forth between the accounts as your business needs change.

Our Rating: ⭐⭐⭐⭐

Best For: Convenience

Notable Features

- Cash Flow Monitor: With the help of the cash management tool, you can connect to payroll, accounting, and analytics apps to aid you in making better business decisions.

- Business Products: Bank of America offers many business products such as CDs, lending products, and savings.

Additionally, you can access financial analysis through Merrill financial advisors.

- Signup bonuses: If you can meet specific qualifications, you can be eligible for $100 to $500 signup bonuses.

Pros:

- Cash-back program: Customers with statement credit can redeem them for cash back for any amount and any time.

- Large ATM network: You don’t have to travel around town looking for an ATM—at least one that won’t charge you an arm and a leg. With approximately 4,100 branches and over 16,000 ATMs, an ATM is always near you.

- Low minimum requirements: At Bank of America, you don’t have to worry about adhering to exorbitant minimums to open a checking account—the minimums are surprisingly low.

- User-friendly: No need to wrestle with a complicated mobile service that’s difficult to use. Bank of America’s mobile app is user-friendly.

- Business integrations: Integration with accounting apps and other software is possible through the online business checking account.

Cons:

- Low-interest rates: Bank of America offers a surprisingly low APY rate of 0.01 percent, which is noticeably lower than other banking companies.

- Slow customer service: An essential component of a good bank is excellent customer service with prompt response times.

Unfortunately, at BoA, a complaint can take several days to resolve.

- Difficult to waive monthly fees: The amount of money you need to become exempt from the monthly maintenance fee is exorbitant.

Pricing & Plans

Bank of America offers two types of business checking: Business Advantage Fundamentals and Business Advantage Relationship.

You need a minimum deposit of $100 to open an account.

Here are the fees for maintaining the Business Advantage Fundamentals account:

- The maintenance fee for the Fundamentals account is $16/month.

However, you can waive the fee if you maintain an average balance of $5,000.

Additionally, you must spend at least $250 with your debit card in each statement cycle.

Alternatively, you can join their rewards program to avoid the fees.

Here are the fees for maintaining the Business Advantage Relationship account:

- The Relationship checking account carries a monthly fee of $29.95.

You can get it waived if you keep at least $15,000 in your account each month.

Opening a savings account comes with a fee of $10/month which the bank waives if you have a minimum daily balance of $2,500.

General fees:

- Cash deposits: Cash deposits are free for up to $7,500/month, and you have to pay 0.30 for every $100 statement cycle.

- Transactions: Your first 200 transactions are free; you pay 0.45 for each transaction.

- ATM fees: There’s no charge to use ATMs in the network, but for transfers, cash withdrawals, and balance inquiries done at ATMs, not in the Bank of America network, it costs $2.50 per transaction.

Interest Rates

The checking account with Bank of America earns zero interest earnings.

The business savings account earns very little interest at 0.01 percent APY, far lower than the 1.5 percent return you receive when banking with BlueVine.

Our Take

Although Bank of America is another traditional bank, it is distinguished thanks to the built-in tools designed to help you manage your business.

They have a team dedicated to small businesses at your disposal to aid you during your business experience.

6. Oxygen

Overview

Oxygen is an online-only bank that offers a business checking account.

You can choose the fee-free option.

Oxygen is the ideal online-only bank for freelancers that want to separate their business and personal finances.

Oxygen is for freelancers and small business owners alike.

Here you can find everything you need to manage your finances optimally.

Our Rating: ⭐⭐⭐⭐

Best For: Earning Cash Back

Notable Features

- Mobile tools: The Oxygen business account includes cash flow projections, account statements, bills, check deposit statements, and more on the mobile app.

- Business integration: Besides integrating the app with your accounting software, you can monitor transactions and upload and tag deductible expenses.

- FDIC- insured: Since Oxygen is not an actual bank, The Bancorp Bank provides its services, and all deposits are insured up to a maximum of $250,000 by the Federal Deposit Insurance Corp.

Pros:

- No fees: There are no fees to worry about, and there are no minimum opening deposit fees.

- Cash back: When you spend money with your business debit card on your Oxygen business account, you can earn 5 percent cash back on your total spending.

The mobile app allows you to track your awards too.

- Debit card innovation: You can have as many as ten virtual cards at one time, each with a limit of $1,000.

- Unlimited transactions: When it comes to wire transfers, not deposits, there’s no limit on how many you can accept.

- ATM access: You can use the Oxygen business debit card to withdraw cash from any 55,000 Allpoint ATMs worldwide.

Cons:

- Mediocre customer service: Customer service representatives don’t always resolve issues promptly.

- Mobile-only: The Oxygen business account does not offer web-based account access because the account is mobile only.

You must download the mobile app to apply and manage your account.

- No lending options: With Oxygen bank, there are no business loans or lines of credit available, which is the case with other competitors.

Pricing & Plans

There are no transfer fees, monthly fees, or opening deposits when you bank with Oxygen.

They have divided their services into elements such as Water, Air, Earth, and Fire.

These elements are known as loyalty tiers and incentivize business owners to succeed.

Fees for the various elements:

- The basic offering begins with the Earth tier and comes with zero fees.

With the savings option as an Earth tier member, you can earn up to 0.50 percent APY.

- The Water is the next tier, costing $19.99 annually; this tier offers many features in addition to the 1.00 percent APY on savings.

- The following two tiers, Air and Fire, cost $49.99 and $199.99 per year, respectively.

The Air tier offers an APY of 2.00 percent, and the Fire tier offers an APY of 3.00 percent on savings.

General fees:

- Cash deposits: Account holders must pay up to $4.95 for every cash deposit.

- ATM fees: Oxygen charges a $3 fee per withdrawal for using an ATM not in the network.

Interest Rates

Oxygen’s interest rates are noteworthy and a little higher than Kabbage and BlueVine, which offer 1.1 percent and 1.5 percent, respectively.

Our Take

Oxygen is definitely outside of the realm of traditional banks.

It brings much innovation and style to the financial sector, offering lucrative opportunities and options chock full of features for business bankers.

Oxygen is a banking option suitable for small business owners.

If you are someone who has yet to create an LLC, you use the Oxygen app to make your LLC through CorpNet, and then you can conveniently open your business account with them.

7. Axos

Overview

Axos is considered an online-first bank dedicated to building an excellent online experience and presence for bankers alike.

Axos is a great option for digital or small businesses and their user-friendly interface browser.

Our Rating: ⭐⭐⭐⭐⭐

Best For: Multiple Checking Options

Notable Features

- Merchant services: Receiving customer payments is an essential part of daily operations.

Thanks to their partnership with Celero Merchant Solutions, they can help your SMB accept payments seamlessly.

- Dedicated customer service: Axos provides secure mail support, built-in messaging, and 24/7 customer support by phone.

- Unlimited features: You get unlimited transactions, payments, deposits, and credits when you bank with Axos.

Pros:

- No fees: There are no maintenance fees for your business checking account with Axos.

- Unlimited ATM reimbursements: One of the best perks about banking with Axos is that they’ll reimburse account holders for any ATM fees (domestic).

- Excellent mobile app: Axos’ mobile app has useful features such as online bill payments, account access, fund transfers, and mobile check deposits, enabling you to do business easily.

The Axos mobile app is available for Android and iOS.

- Multiple checking account options: Axos offers business checking accounts: Business Interest Checking and Basic Business Checking.

- Free cash deposits: As an Axos customer, you can make cash deposits free from any of the AllPoint or MoneyPass ATMs across the United States.

Cons:

- Wire transfer fees: After the first two free wire transfers, there are fees for every outgoing wire transfer.

- No branch locations: This may make Axos less appealing for those who prefer to speak with someone in person.

- Maintenance fees: Business Interest Checking comes with a monthly maintenance fee; however, you can waive it.

Pricing & Plans

The Business Interest Checking account has a $10/month fee, while the Basic Business Checking doesn’t come with a monthly charge.

General fees:

- Cash deposits: Cash deposits are free if you use an ATM within the network.

- ATM fees: Axos doesn’t charge any ATM fees, and they offer unlimited reimbursements for in-network ATM transactions and up to $8 for out-of-network transactions.

Interest Rates

Even though Axos bank’s customers have access to many interest-bearing options, their yield rates aren’t on par with some other competitive banks.

There is no APY on their basic checking account.

Their checking account that bears interest offers an APY of 1.01 percent.

Our Take

Axos is an excellent choice for anyone who enjoys online banking.

This full-service online bank offers free cash deposits across AllPoint and MoneyPass locations across the United States.

New business owners receive a $200 welcome bonus.

8. Chase Business

Overview

Chase Business is an excellent choice for business owners looking for a place to deposit cash.

In addition to its massive ATM network, Chase Business has many physical branches you can frequent.

Chase’s business checking accounts offer cash deposits and a business debit card at their physical locations.

Our Rating: ⭐⭐⭐⭐

Best For: Integrations with Accounting Software

Notable Features

- Mobile and online banking tools: Chase’s online banking and mobile include fraud protection, text banking, bill pay, Zelle, Chase QuickPay, and account alerts.

- Integrated credit card processing: Using that Chase mobile app, you can accept credit card payments with the Chase QuickAccept feature; it is a pay-as-you-go integrated credit card processing service that connects to a mobile card reader to swipe, dip or tap transactions.

- Easy application process: Getting a business account with Chase is simple and easy to sign up for.

Pros:

- Unlimited electronic deposits: Although there are limits to specific kinds of deposits that you can make, electronic deposits do not have a limit.

- Large ATM network: They have approximately 16,000 ATMs and nearly 4,900 branches.

So depositing money or finding a place to withdraw money shouldn’t pose a problem.

- Security: Chase provides free fraud protection services.

You can be sure that your funds are safe and secure at no extra charge.

- Third-party applications: Chase offers integration QuickBooks and other accounting software.

- Signup bonus: When you open an account with Chase, you can earn a $300 signup bonus.

Cons:

- ATM fees not reimbursed: There are no reimbursements for either foreign or domestic ATM transactions for customers.

- A limited number of free transactions: In the Chase Business Complete Checking account, you’re limited to $5,000 of cash deposits per month which are fee free; this includes in-person deposits, withdrawals, and paper checks each month.

- High fees: Customers and potential customers should be aware of the exorbitant overdraft fees.

Pricing & Plans

Chase has three business checking account options:

- Chase Business Complete Checking: Fees are $15/month

They will waive this fee if you maintain a minimum daily balance of $2,000.

- Chase Performance Business Checking: The fee is $30/month

They will waive this fee if you maintain a combined average beginning day balance of $35,000.

- Chase Platinum Business Checking: The fee is $95/month

They will waive off if you maintain a combined average beginning day balance of $100,000.

General fees:

- Cash deposits: There are no fees for cash deposits up to $5,000/month, after which you pay $4.95 each.

- ATM fees: You’ll pay a $3 fee for using an out-of-network ATM.

- Transactions: The first 20 physical transactions are free each month.

After that, every transaction costs 0.40. The premium accounts allow up to 250 transactions each month.

Interest Rates

There is no APY on deposits with Chase Business Checking accounts.

Our Take

Chase business checking is a wonderful option for business owners looking for business banking from a brick-and-mortar institution.

By choosing Chase, you gain access to over 4,700 branches, 16,000 Chase ATMs, mobile and online banking, and various small-business services offered by Chase Bank.

9. Lili

Overview

Business owners of the freelancer variety will enjoy Lili, an online business checking account designed specifically for them.

There’s no minimum open deposit or monthly fees, and its built-in tools are useful.

By all metrics, it’s a great online business checking account.

Our Rating: ⭐⭐⭐⭐

Best For: Freelancers

Notable Features

- Unique tax tool: Lili offers a groundbreaking tax-saving tool designed for you to set money aside automatically for taxes on all of your income.

- Savings tool: The Emergency Bucket is a tool that you can use to help customers to save money in the case of emergencies with small deposits made daily.

- Balance Up: For Pro plan customers, Lili offers overdraft protection for up to $200 in purchases when you use a debit card.

Pros:

- Easy-to-use app: The app has a clean layout and is easy to navigate, which is crucial for business owners who aren’t necessarily tech-savvy.

- Extensive ATM network: Lili presently has over 38,000 ATMs in the United States.

Using the ATM locator on the mobile app, you can find the nearest ATM.

- Expense tracking: Lili allows you to monitor your business expenses on the go through the mobile app.

- No balance minimums: You don’t have to maintain a minimum balance to avoid fees.

- Invoicing: Depending on the type of business you have, it’s convenient to be able to create and send invoices easily.

Cons:

- Low monthly deposit limits: Lili limits mobile check deposits to $6,000/month, with a maximum allowance of six monthly checks.

This drawback is inconvenient if you have a large company and frequently do transactions involving checks.

- Limited lending solutions: There aren’t any beneficial lending or merchant services, which means business owners would have to look into a different institution for financial assistance.

- Not suitable for large businesses: While Lili is perfect for small businesses, there may not be enough tools for larger companies.

Pricing & Plans

Lili doesn’t charge for their standard banking services.

Additionally, there is no minimum balance requirement, ATM, monthly, or overdraft fee.

On the other hand, Lili Pro is an upgraded option that costs $4.99/month.

With this account, there is a low monthly fee; however, there’s no required minimum balance.

General fees:

- Cash deposits: While Lili bank doesn’t charge a fee for cash deposits, their partner Green Dot Bank does charge $4.95 per transaction.

Interest Rates

If you sign up for Lili’s standard features, there’s zero APY.

However, if you choose Lili Pro, you can earn up to 1.00 percent APY with a savings account.

Our Take

Lili is a fitting choice for a small business run by a single person.

It is a conglomeration of a business checking account and personal bank accounts, making it a perfect choice for small businesses because of the middle ground it strikes.

Lastly, they are FDIC-insured.

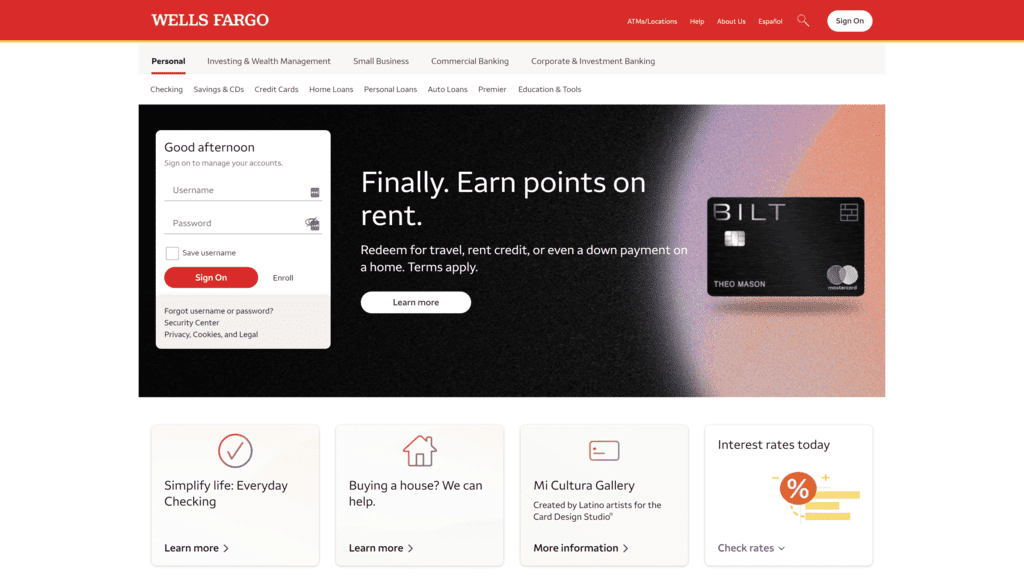

10. Wells Fargo

Wells Fargo is a versatile banking option for business owners; they offer merchant services, business loans, and three checking account options.

One drawback, in particular, is the ATM fees and the monthly fees—which are especially concerning for startups and businesses who have to deal with tight margins.

Overview

Wells Fargo is a versatile banking option for business owners; they offer merchant services, business loans, and three checking account options.

One drawback, in particular, is the ATM fees and the monthly fees—which are especially concerning for startups and businesses who have to deal with tight margins.

With that said, Wells Fargo is an ideal choice for small business owners, and they happen to be more lenient with their requirements for SBA loans.

Our Rating: ⭐⭐⭐⭐

Best For: Ease of Access

Notable Features

- Fraud protection: Wells Fargo offers zero liability debit card protection and continuous fraud monitoring; this allows business owners to rest assured that their funds are safe with this institution.

- Numerous branch locations: It has over 4,900 branches, more than any other bank in the United States.

Having the option to speak to someone in person in a convenient location close to your business is essential.

- Caters to growing businesses: Wells Fargo has three business checking accounts—with every upgrade, the features increase as well.

If your business outgrows an account, upgrade to one that allows for more deposits and transactions.

Pros:

- Easy to apply: The application process is smooth and doesn’t take long if you have all of your paperwork prepared.

- Low opening balance: There are three account options, each with a low deposit requirement.

- Waivable fees: You can waive the fees by maintaining a specific balance depending on which business account you sign up for.

- Various checking options: Wells Fargo offers several checking account options for different sizes of businesses.

- Prompt notifications: You can get email and text alerts for account activity.

Cons:

- Limits on free transactions: Every business checking account has a limit on free transactions.

For example, the highest tier only allows for 250 free transactions monthly.

- Balance Requirement: You must maintain a $500 minimum daily balance to avoid the $10 fee.

- No free checking option: Each Wells Fargo business checking account has a fee for monthly maintenance; fees can range from $10 to $75/month, depending on the account.

Pricing & Plans

Wells Fargo offers three business checking accounts (Initiate, Navigate, and Optimized business accounts), each requiring a $25 deposit to open the account.

- The monthly fees range from $14-$40/month, but it depends on which type of business checking account you choose.

If account holders want the bank to waive these fees, they have to maintain a $500 daily balance for the Initiate account, or $10,000 for the Navigate account.

General fees:

- Transaction fee: You must pay 0.50 for each transaction after the first 200 allowed monthly (250 transactions are permissible for the Navigate and Optimized accounts).

- Cash deposit fee: You’ll pay 0.30 per $100 of cash deposits beyond $5,000-$20,000 each month, depending on the account type.

- ATM fee: Customers have to pay $2.50 for every withdrawal and $2 per balance inquiry at ATMs that are out of the network.

Interest Rates

Wells Fargo doesn’t offer an APY on the Initiate or Optimized business accounts, but interest rates vary for the Navigate account.

Our Take

The Basic Checking Account is a fantastic option for people who are just beginning or have less activity.

The minimum is very low, which allows you to waive the monthly fee.

If you happen to outgrow your checking account, there are two higher upgraded accounts that you can choose from.

They have premium benefits like banking fee waivers and higher monthly limits.

Features To Look for in a Business Checking Account

When choosing a business account, keep these features in mind before you make a decision:

Fees & Terms

It is essential to keep your fees to a minimum since you’ll be utilizing them to process your day-to-day transactions for your business.

Specifically, look at the monthly maintenance fees, transaction fees, or out-of-network ATM fees.

Interest Rates

If you have a business checking account that earns interest, ensure that fees don’t offset your earning potential and that you meet minimum balance requirements.

On another note, if you want to save money on a longer-term basis and don’t need access to your money daily, a business savings account may be the best choice for earning interest.

ATM Access

Consider questions such as where you can use your business debit card.

Do you accrue fees for using your card outside the bank’s ATM network?

Are there any ATM fee reimbursements from your business checking account?

Do you have both cash withdrawals and deposits from your ATM access?

Transaction Limits

Observing any limits that may apply to your account is essential, as you would likely have to process more transactions for every statement cycle with your business account.

Some banks may limit your deposits or withdrawals, and others may limit the number or type of transactions you can make.

Choose an account that can handle your typical transaction volume.

Ease of Integration

It’s crucial to ensure that you can connect your business checking account with your accounting and bookkeeping software.

Some banks have provided built-in functionality to make integration simple.

You should be looking for Fintech or banking services that integrate software like Quicken, Wave, Xero, Quickbooks, and Mint.

Frequently Asked Questions

Here are the answers to the most commonly asked questions concerning a checking account for an LLC.

How to open a business bank account for your LLC?

If you are the owner of an LLC, open a business bank account by following these simple steps:

- Select the appropriate account. Compare several options and consider variables such as cash deposits, transaction limits, ATM access, fees, and other pertinent features.

- Gather your LLC documentation: The required documentation can vary according to your state and bank.

- Fill out, complete, and submit your application.

Does an LLC need a business bank account?

LLC is a distinct legal entity; therefore, owners have to open a dedicated business checking account for the company in question.

In short, an LLC needs a bank account because it’s incorporated.

An LLC bank account grants you easier financial management, liability protection, and a more straightforward process of filing tax returns.

Can you use a personal checking account for an LLC?

Even though no state or federal law disallows you from using your personal bank account, you should open a distinct business bank account for your LLC.

Doing so will enable you to separate your business and personal finances while maintaining liability protections.

Do credit unions offer better business checking accounts?

Since credit unions are nonprofit institutions, they usually offer lower interest rates on loans and higher interest rates on deposits.

Additionally, credit unions may emphasize customer service more than a typical bank.

However, ensure that your credit union has specific features that benefit you.

Do I need a minimum balance to open a business checking account?

After you’ve separated your personal from your business identity, you may have to deposit money initially into your account.

Initial deposits and the minimum balance amount will vary according to account type and bank.

Choose a business bank account whose initial deposit amount and minimum daily balance are reasonable for your business.

Conclusion

The best business checking account for LLC depends on multiple factors, the chief of which is your particular business goals and needs.

A business account is necessary to separate your business finances from personal finances and reap the benefits of other services and resources.

Lines of credit, credit cards, business loans, invoicing and analytics tools, and more are at your disposal with a business checking account.

BlueVine is the best option on the list, as they encompass many of the best features for a business account.

They have one of the highest APY rates on the list, which is quite generous; they don’t charge monthly fees, there’s no minimum deposit for opening an account, and the account is software-integration capable.

The next best thing is between Lili and Kabbage, as they offer similar services and have a similar fee structure.

However, Kabbage has business integration options from their company, tax and savings tools, and a high APY rate.

Sign up for a BlueVine account today or another, more traditional bank, as long as you know its fee schedule.